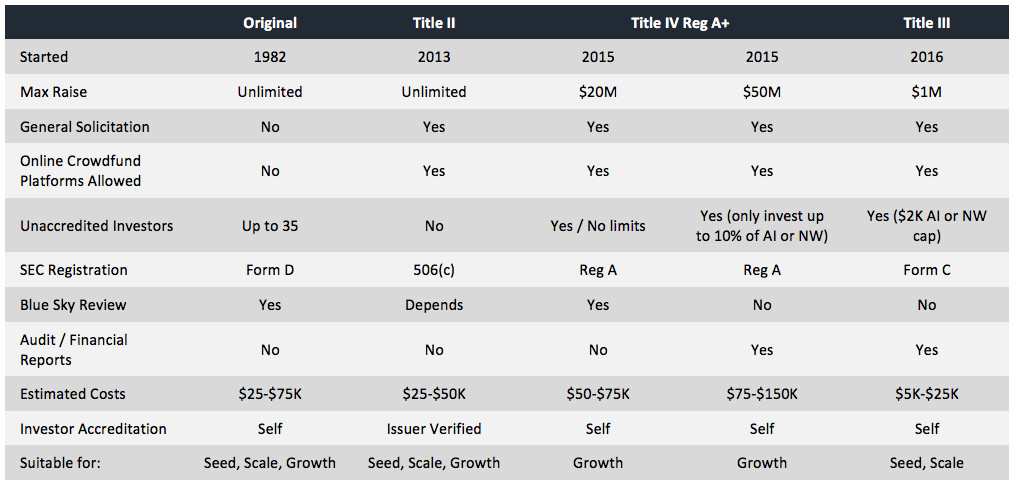

In the last few years we have seen the introduction of new rules that are designed to make access to capital more available to early stage companies. It has been widely reported that results have been mixed, at best.

There are several alternative approaches for sure, and issuers need to be clear about what their options are and what the best option is to meet their specific needs are, as well as which option will give them the best opportunity to succeed.

Issuers setting out to generally solicit their offering should set their expectations realistically. Just because you can now mass-advertise your offering and even market your offering to non-accredited investors (under Reg A+), there are no guarantees. The fact is that more often than not, issuers are disappointed at the level of interest and participation from the crowd.

So what can an issuer do to level-set its expectations? Test the waters. One of the best ways to do that is to plan and execute a rewards-based campaign, like Kickstarter, in anticipation of a planned 506(c) or Reg A+ offering. There are several benefits to doing this:

- It allows the issuer to gauge the interest, or “deal heat” in its value proposition from the general public. Chances are pretty good that if your rewards-based campaign generates a buzz that a larger campaign will have some level of success. On the other hand, if it is not well-received, then you might want to rethink what you are doing before you invest the time and resources in a larger offering.

- It offers “social validation”. If your rewards-based campaign is a success, you will be able to use that as proof that other people believe in what you are doing. Social validation is invaluable as you pitch to other investors.

- A reliable strategy to plan a future round. The level of traction your rewards-based campaign gets can be highly useful in the process of determining how much capital you should target raising, the terms you should offer to attract investors and even how viable your pitch is and if you should go back and make any changes. Past results are no guarantee, but they are a legitimate indicator of future interest.

- It can be a great way to start building a database of investors into future rounds. Folks that chip in to your rewards-based campaign are chipping in because they believe in your product or service. They are not chipping with an expectation of liquidity in their investment or for equity in your business at all These are the true believers. Is there anyone better to convert into a shareholder in future rounds?

- Potential to launch future offering with stronger buzz. A successful rewards-based campaign can be used to get media attention and build awareness for future offerings in a way that would not have been possible without having achieved that success and built that traction.

- Can enable a larger budget and defray expenses for more proactive funding round.Administrative, legal and marketing costs to launching a Rule 506(c) or Reg A+ round can range. A successful rewards-based campaign can provide capital to ensure the issuer will be able to take full advantage of all resources available in future rounds of financing.

Nothing chills the offering process and undermines business planning more than launching a campaign only to receive a lackluster response. There are a lot of different reasons that campaigns fail but it all basically comes down to the fact that the issuer’s value proposition failed to resonate.

“Testing the waters” within the context of a campaign to generally solicit securities is most often associated with the ability of an issuer to ask for some kind of indication of interest from prospective investors with respect to participating in the issuer’s offering. But it is nonbinding and often unreliable. An issuer might get overconfident in the interest in its offering because of a strong response of so-called interest in its offering, only to get much less actual participation when it pushes forward to its offering. And it may have let that confidence drive its offering terms resulting in an “ask” which doesn’t ultimately balance with the public’s perception of what it is receiving in the “offer” side of the equation.

On the other hand, companies considering selling securities through a Rule 506(c) or Reg A+ offering would be well-served to first test the waters with a rewards-based program to get a sense for the reception that offering is likely to receive. In this case, there is measurable behavior that the issuer can use to better inform its capitalization strategy.